- Nationwide – Integration planning for two building societies, covering actions required to integrate retail and contact centres and deliver related merger benefits, while insulating customers from impacts

- Netia/Tele2 –Assessed customer operations of alternative Telcos with radically different operating models, to develop single operating model to deliver acquisition benefits

- Private equity, acquisition of market researcher –Assessed separation plans from parent, and cost reduction plans based on technology and outsourcing

- TDF/Antenna Hungaria – Developed detailed plan to help TDF take control of AH, realign its strategy to an infrastructure focus and deliver cost savings. Led management team to agree integration objectives

- European Cable TV Altnet –Synergy planning across sales, marketing and networks in preparation for final binding offer for other competing Altnet delivering Pay TV, MVNO and fixed telecoms services.

- Innovation – Acquisition planning for a publicly quoted client to enable it to acquire, under Class 1 procedures, a loss making business and plan delivery of synergies required to turn it around

- Key player in the music industry – Reviewed previous restructuring actions and a plan to reduce costs, analysing cost base, identifying major risks to base case plan and some upsides

- Mach–Synergy planning to support financing of acquisition and integration of a mobile billing intermediary business

- PE House/Towers Business – Assessed synergy to raise £250m of finance, covering integration of field operations, procurement, and investment programmes

- Towers Business –Post acquisition merger planning under onerous ‘Hold Separate’ conditions, helping to control a high level of business risk, putting in place a ‘ready to go’ integration programme

- PE House, owner of media service business –Advice and challenge on ‘low-balled’ synergies. Helped PE House obtain commitment from top management to higher and more reasonable synergy projections

- Datatec – Operational Due Diligence. Identified key issues on acquisition of distressed US network integrator for group building worldwide service delivery footprint

- Datatec – Analysed similarities and differences in two acquisitions with a high degree of overlap, but some unique elements. Proposed new structures and a carve out/integration roadmap

- Macquarie – Assessed vendor preparations for the separation of Airwave from O2, assessing issues, e.g. impact on contracts, and standalone costs, and developed separation roadmap for acquiring PE house

- Financial Trading Business – Advice on people, transaction and valuation issues created in carving out and moving a business within a complex corporate structure, including General Partnership, LLP and PLC entities

- Macquarie – Diligence for Arqiva refinance – Assessed execution risk on a massive contract with large failure penalties and assumptions underlying a £1b Capexplan

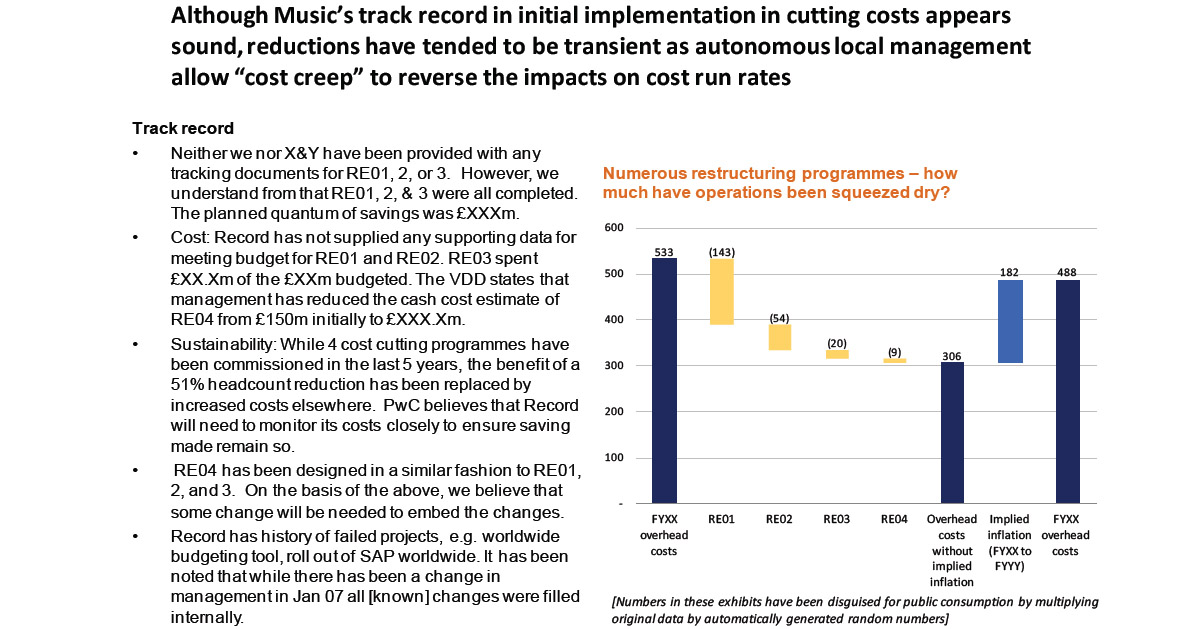

- Assessing cost reduction proposals and past programmes for a ‘Take private’

- As part of a ‘Take private’, provided an opinion on a PE House’s cost reduction plan, analysing the cost structure of a major player in the music industry and its recent major restructuring programmes

Major music industry player

Assessing cost reduction proposals and past restructuring programmes

Prior to announcing its annual results, a major player in the Music industry decided to make itself available by auction to bidders, with public reporting timetables effectively providing an immovable deadline to the process. Changes in consumer purchasing behaviour and piracy had challenged current industry business models, led to reduced sales, and necessitated major and regular cost cutting and restructuring. The business had recently announced two profits warnings and major cost cutting programmes. In parallel, with the assistance of an expert industry team – effectively a management team in waiting – a PE firm had constructed its own cost savings plan. Diligence work needed to address the risks of overlap and the risk of damage to core business through cuts being too severe.

Financial, commercial and operational due diligence was needed to support to a PE firm’s assessment of an opportunity to take private this music industry business. David led a team that analysed the target’s cost structure, its previous restructuring programmes and the PE firm’s own cost reduction plan. This work drew on data in a data room, meetings with Target management and interviews with architects of the Cerberus cost reduction plan. Business segments and geographies were analysed to understand cost structure, drivers and previous restructuring initiatives. David’s team drew from its analysis of cost structure likely areas for improvement. Separately, they analysed the PE plan’s rationale, estimates of quantum, implementation dependencies and timing of benefit. Together with outputs from the analysis of cost structure, they provided a clear view on the reasonableness on projected savings and their timing.

During the work, our diligence work enabled (1) several inconsistencies in the PE firm’s plan to be removed (2) identified upside to offset some of the timing and quantum risk within the plan, and (3) identified risks is a business where cost reductions seldom stuck.