- Nationwide – Integration planning for two building societies, covering actions required to integrate retail and contact centres and deliver related merger benefits, while insulating customers from impacts

- Netia/Tele2 –Assessed customer operations of alternative Telcos with radically different operating models, to develop single operating model to deliver acquisition benefits

- Private equity, acquisition of market researcher –Assessed separation plans from parent, and cost reduction plans based on technology and outsourcing

- TDF/Antenna Hungaria – Developed detailed plan to help TDF take control of AH, realign its strategy to an infrastructure focus and deliver cost savings. Led management team to agree integration objectives

- European Cable TV Altnet –Synergy planning across sales, marketing and networks in preparation for final binding offer for other competing Altnet delivering Pay TV, MVNO and fixed telecoms services.

- Innovation – Acquisition planning for a publicly quoted client to enable it to acquire, under Class 1 procedures, a loss making business and plan delivery of synergies required to turn it around

- Key player in the music industry – Reviewed previous restructuring actions and a plan to reduce costs, analysing cost base, identifying major risks to base case plan and some upsides

- Mach–Synergy planning to support financing of acquisition and integration of a mobile billing intermediary business

- PE House/Towers Business – Assessed synergy to raise £250m of finance, covering integration of field operations, procurement, and investment programmes

- Towers Business –Post acquisition merger planning under onerous ‘Hold Separate’ conditions, helping to control a high level of business risk, putting in place a ‘ready to go’ integration programme

- PE House, owner of media service business –Advice and challenge on ‘low-balled’ synergies. Helped PE House obtain commitment from top management to higher and more reasonable synergy projections

- Datatec – Operational Due Diligence. Identified key issues on acquisition of distressed US network integrator for group building worldwide service delivery footprint

- Datatec – Analysed similarities and differences in two acquisitions with a high degree of overlap, but some unique elements. Proposed new structures and a carve out/integration roadmap

- Macquarie – Assessed vendor preparations for the separation of Airwave from O2, assessing issues, e.g. impact on contracts, and standalone costs, and developed separation roadmap for acquiring PE house

- Financial Trading Business – Advice on people, transaction and valuation issues created in carving out and moving a business within a complex corporate structure, including General Partnership, LLP and PLC entities

- Macquarie – Diligence for Arqiva refinance – Assessed execution risk on a massive contract with large failure penalties and assumptions underlying a £1b Capexplan

- Advising on post merger integration

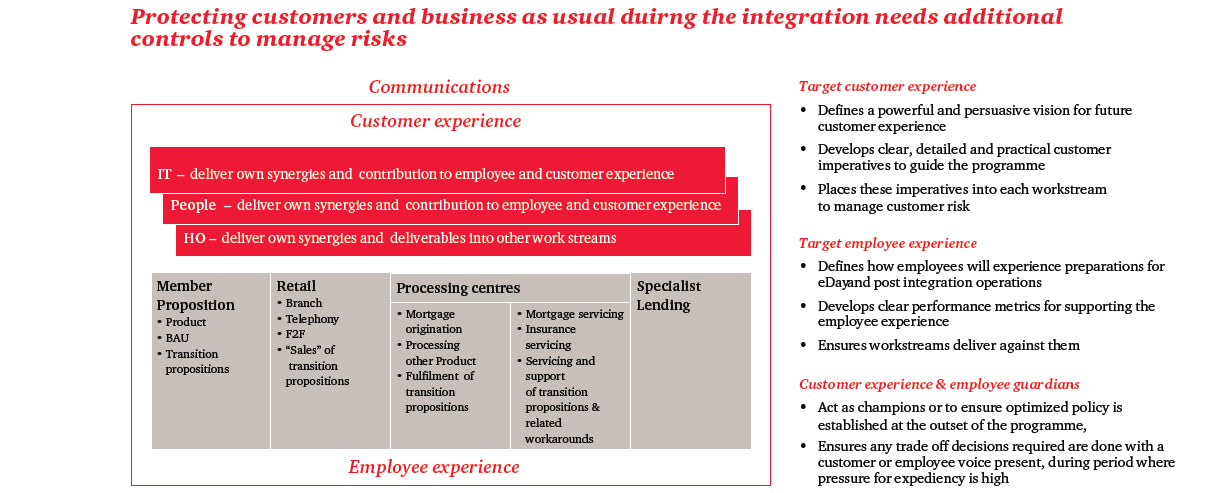

- Provided advice and challenge to ensure an integration programme design for retail, contact centre and servicing operations protected customers from impact while delivering reduced costs

Nationwide

Synergy planning and Post Merger Integration

Nationwide acquired Portman Building society, a commercially energetic lender that had built a successful specialised lending business to run alongside its ‘best buy’ residential mortgage business. Nationwide needed to commit in its merger booklet to the future shape of the merged society and needed to develop with Portman robust business designs and plans to underpin these commitments. The society had decided to take early synergies by shutting down branches in overlap areas on Day One and rationalising call centres. A particular concern was how to do this without creating difficulties in delivering service.

We reviewed and validated management synergy estimates, for example from branch, call centre and servicing overlap. We provided full decision making support, as well as advice and challenge on programme design and management. David’s responsibility was to provide ‘advice and challenge’ to the Retail and Member Proposition workstreams, covering integration of branches and contact centres, branch closures, rationalisation of product portfolios, process change to support Portman ‘back books’, and planning for customer, savings and mortgage data migration. David provided advice to workstream sponsors and managers on the structure and content of the projects required, drawing on his experience of analogous change projects, for example mortgage data migration. He also led workshops and provided stakeholder management to develop and gain agreement to a detailed designs, particularly around the revised Branch Operating Model to enable Portman customers to present their passbooks, and receive service once the mortgage was effective.

David helped these critical workstreams deliver the plans and designs of the quality required to meet the integration fundamentals required of the programme by the societies’ boards. The plans were successfully delivered by Nationwide and Portman.

Of more concern was the impact of a ‘price war’ resulting in a price decline of 46% in a year. Facing this, management met EBITDA targets through volume growth and major cuts to most aspects of operational expenditure. In making these decisions, management was able to show it had, in the short run, properly considered risk. We recommended implementation of streamline controls on promotions, allowing a response to market development with better managed risks. We alerted the centre to the intensity of the price war, and recommended specific additional controls to ensure that overly aggressive decisions by local management did increase jeopardise the viability of the business.