- Consortium major UK Telcos – Delivery of an independent assessment of cost impact of regulatory proposals for industry change to ensure correct decisions taken and appropriate budgets allocated

- Neareast Telco –Business plan and market entry strategy for Turkey to become the ‘location of choice’ for the offshore contact centre outsourcing and grow GDP by 3-4%

- Major Telco – Provided advice to reduce risk after assessing the operations, cost base and key contracts of Panamanian customer operations, for business operating in a highly competitive market

- Major Telco – Eire – Working for CFO, provided advice and challenge to Customer Service Director and team, securing agreement to a Multi Channel Call Volume Reduction initiative to reduce opex by €5.6Mpa

- Major Telco, UK – Review of value-for-money and operation of customer service outsourcing contracts to assess scope for reducing operating cost through price reduction or more rigorous application of service credit regimes in the contracts

- Orange TPSA Telco – Improved customer experience to address a major gap between an acquired subsidiary’s service quality and its parent’s global brand, putting in place actions to address inconsistent service delivery and major weaknesses in frontline supervision

- Retail bank – Reviewed a cost reduction plan impacting head offce and customer service, assessing rationale, ambition of cost saving quantum and risks to revenue line due to changes in customer services. Recommended mitigations

- Power – Reducing the risk of repeat multimillion pound fines by the regulator for mis-selling by advising on new supplier and contract

- Water utility – Provide advice to help develop unit cost reports and benchmarks for a customer service organisation with a previously opaque cost structure, and a requirement to enhance cash flows to PE-style owner

- Clientwise – Delivery of a £2M custom development of opportunity management processes using an agile method and Business Process Management software

- Large police force –Validated cost reduction plan, identifying additional opportunity, following a review of four call handling operations over six sites, as key input to a cost reduction programme

- Major airline, Middle East – Assessed performance of contact centres in UK, Middle East, Philippines and India, identifying major opportunities to reduce cost and reduce lost sales revenues by implementing good practices 14

- Transport operation – Reviewed the customer contact operations and cost base serving major metropolis, identifying three major opportunities to reduce costs by 35-60% through performance improvement, relocation and ceasing elective services

- Local government – Created a process for commissioning proactive customer services to address Life Events and designed the required Customer Service Centre Operating model

- HMRC – Researched experience in FS and outsourcing organisations with front and back offce integration, to apply it to its problems in delivering a reasonable customer experience effciently and lower cost

- Premium TV – As part of a start up to deliver tax benefits, seconded to run customer services to ensure compliance to tax effcient model, also delivering £2m cost saving in outsource contract

- Product insurer – Identified alternatives to costly premises move to resolve capacity issue, Reviewed operations to identify major opportunities to improve sales and reduce cost. Presented strategy to board and mobilised management to deliver it

- Utility – Resolved resource issues caused by business preparation workload from major change programme by procuring flexible outsourced service with guaranteed quality at costs 60% below more risky UK internal options

- HMG – Emergency intervention to assess failing outsource provider, identify and recommend improvement actions and provide a view on long term prospects to inform contractual decisions

- Barclays/GHL – Completed integration of Woolwich & Barclays mortgage customer operations, reducing cost. Led team to deliver data conversion, improved processes and new servicing, direct debit and other applications

- Scottish Power – Improved productivity by 35% in multi service utility built through acquisition, by identifying and rectifying weaknesses in team and CSA management, challenging, mobilising and leading an initially sceptical senior management team to support change

- Barclaycard – Reduced cost by designing and delivering a virtual call centre needed to support a 15% headcount reduction, leading a mixed consultant/ client delivery team, and managing issues with stakeholders

- Interflora – Enabled transformation to cut costs and improve services, supporting and leading its management team through complex decisions on IT, process change and vendor selection

- Scottish Equitable – Prepared a potent case for change for board member and advice on creating a ‘customer front offce’, enabling investment in replacement of poor customer care operations

- Cable & Wireless – Enabled Telco to develop an effective partner channel, working with Sales Director to define ‘partner of choice’ vision, then lead detailed work on supporting processes and implementation roadmap

- Centrica – Accelerated Centrica’s planning for customer service within its telecoms retailing start up operation, by giving expert input on best practices and its ‘current state’

- Energy utility – Designed and delivered a solution to deal with extreme demand on a call centre, to avoid a repeat of a customer service debacle

- Energy utility – Advised utility with network of high street stores on how and when to implement a virtual call centre across contact centre, retail branches and home workers

- Energy utility – Advised on how to improve productivity and fault management, using solutions automatically identifying customers

- Ofgem – Provided assurance to the government and industry that preparations for the introduction of competition would result in a smoothly customer and market operations HMG Department of Heath

- HMG Department of Health – Improved customer service through competition and innovative service design, leading strategy development and advising on procurement of £50m contract for outsourced contact centre services 44

- BBC – Advised the BBC on integration of BskyB services, customer and operational processes to enable it to use digital satellite broadcasting within its delivery infrastructure

- Specialised travel business – Assessed call centre and retail operations for a travel business, identifying £8m pa of cost saving and margin improvement

- ATPI – Assessed a travel operator with many small contact centres on behalf of a PE House, and challenged the ineffcient operating model of a travel firm to reveal upside

- Acquisition of market researcher – Assessed cost reduction plans to leverage increased offshoring and better contact centre processes in data collection and processing operations

- Private equity – Validated forecasts for a debt collection business, advising and challenging benefit estimates from the use of outbound telephony calls to ensure they were reasonable

- Innovation – Acquisition planning for a publicly quoted client to enable it to acquire, under Class 1 procedures, a loss making business and plan delivery of synergies required to turn it around

- Project Mozart ‘Take private’ deal – Provided advice on commission claw back, FSA mis-selling and other risks within a financial services business, reviewing cost saving opportunities

- Altnet start up – Advised on actions required to correct misalignment between strategy plan to be a world-class customer orientated Telco and what in practice was being implemented

- Chemical reagent manufacturer – Identified opportunity to deliver breakthrough performance in services, following a review of operations

- BskyB – Provided advice on customer service and billing change to enable of Europe’s largest customer service organisations to understand how to meet ambitions to be world class

- Retailer – Reviewed UK retail business of 5,000 outlet global services retailer, covering shop portfolio, processes and personnel to determine changes required to improve profitability

- Energy utility – Scottish Hydro – Developing and analysing options for new sales operations to enable entry into new markets. Specifying and advising on outsourcing outbound telesales

- Energy utility – British Gas Trading – New entrant to second tier electricity supply, Identifying and selecting of options for customer service for second tier electricity supply Major utility – Accelerating an outsource transaction, informing decision making with best practice prior to a 2,500 seat outsource

- Large public sector organisation – Diagnosis of customer service, technology and management issues after a major building move

- Major retailer – Identifying significant retail customer service savings through benchmarking

- Dispensing appliance retailer –Review of customer services function to determine whether the current processes and ways of working were fit for growth

- Major UK bank – De-risking IT design and implementation project delivering mission critical contact centre infrastructure

- Major industry restructure – Assessment of customer experience and financial risks from the introduction of billing for water services during an industry restructuring

- Luxury hotel chain – Design of technology, people and location changes to enable a superb customer experience to be delivered at reduced cost

- Major international Hotels Group – Major Hotel brand – assessment and digital strategy development across international online and call centre channels for Customer Relations and Loyalty operations

- Car insurer– Assessment of customer contact operations and management in a “post start-up” telematics insurance company to determine opportunities to increase sales and reduce costs

- Property business – Designing a single interaction centre to reduce costs by over 50% and improve customer experience

- Property business– Designing an operating model to consolidate three contact centres and reduce costs by over 50%

- Current state assessment

- Solution initiatives definition

- Improved sales and reducing costs by reviewing operations, identifying major opportunities and designing a strategy to deliver the value

- PE owned, recommendations increased value by c. £100M

Product insurer

Improving sales and reducing costs

A m ajor UK product insurer runs two related businesses. One business obtains valuable customer data, full of s ales opportunity, from a wide range of product manufacturers and retailers, and creates value by executing outbound, inbound and white mail marketing campaigns from two call centres with c.700 FTE on outbound and 800 FTE on inbound selling. The second business was the provision of outsourced telemarketing services t o a range of financial service clients. Our client’s UK property estate was close to capacity, while leases on key buildings were due to expire in the next three years. Private Equity owned, with a possible exit in the next few years, management asked David to review its operations and recommend a value optimising strategy.

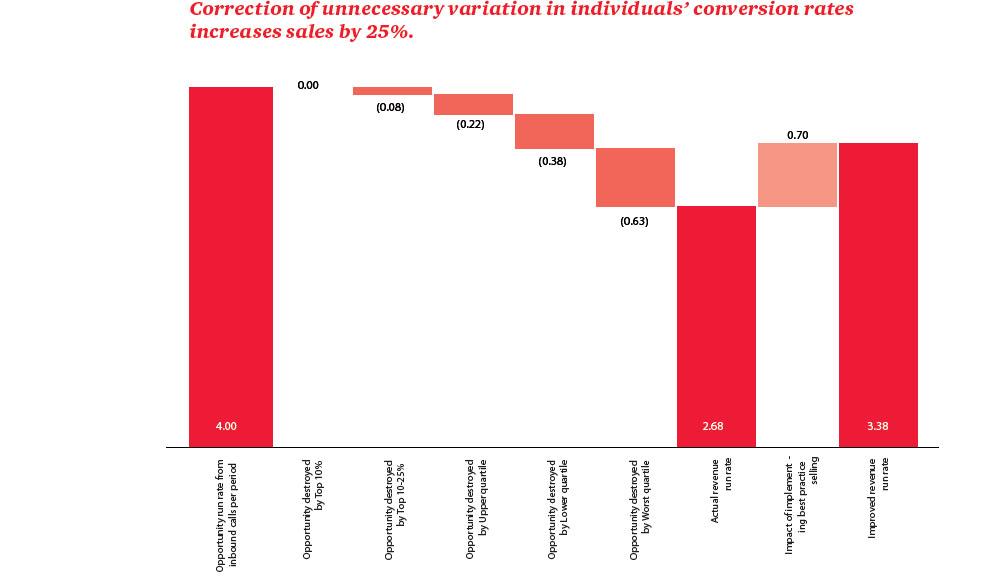

The team, led by David, interviewed key players, assessed facilities and analysed recordings of inbound and out bound calls. We analysed in depth performance information, from the ratio of call attempts to Decision Maker Contacts and conversion rates, to the cost drivers such as average call handling time and staff utilisation. We compared its costs against leading practice benchmarks obtained from outsource procurements David had led. David’s work identified two key opp ortunities. Firstly, there was a si gnificant prospect – c.35% – of increasing revenue, by reduci ng the revenue opportunity lost by l ess competent sales staff. Secondly costs were too high

- in excess of 30% more than best practice benchmarks. We identified the reasons underlying this inefficiency - and developed seven initiatives focussed on delivering benefits through better management of team performance, process improvement and targeted use of outsourcing.

We also assessed risks and opportunities on the property estate, where our client had perceptions that there was a ‘burning platform’ around capacity constraints that necessitated a location move. We found the risks could be mitigated without the need for risky and costly building moves, and a location move was highly likely to destroy value. The initiatives were conservatively expected to deliver an EBITDA improvement of £10m pa from cost reduction and revenue growth. David’s work on the property decisions helped prevent unnecessary investment in a move of c.£6m.